Introduction

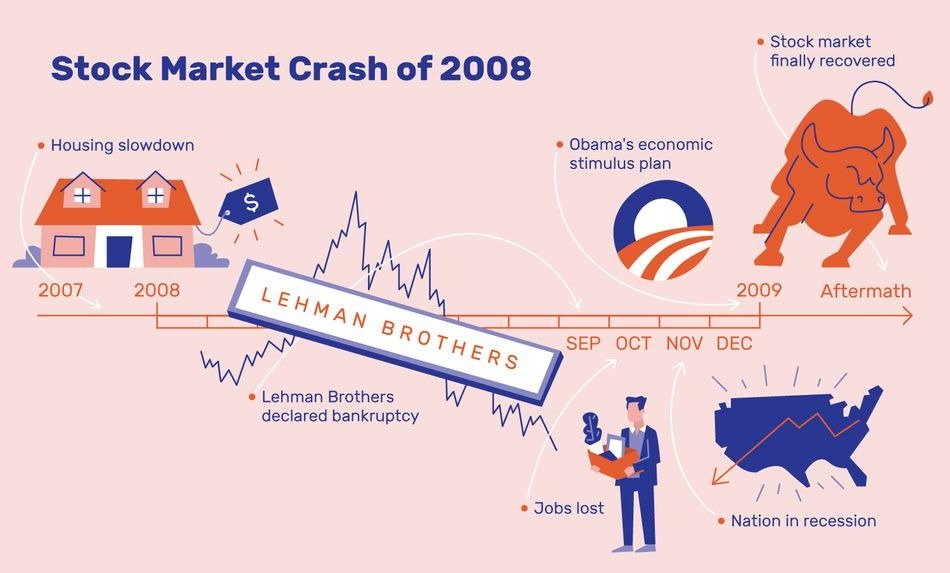

In 2008, the world watched in disbelief as the U.S. stock market experienced one of the worst crashes in history. The Dow Jones 2008 crash symbolized the peak of the financial turmoil that led to the Great Recession—a global economic crisis triggered by the collapse of major financial institutions and a bursting housing bubble. This article explores the events, causes, consequences, and long-term effects of this catastrophic event while optimizing for all related key terms.

Table of Contents

What Is the Dow Jones?

The Dow Jones Industrial Average (DJIA) is one of the oldest and most recognized stock market indices in the world. It tracks the performance of 30 large publicly-owned U.S. companies and serves as a barometer for the overall health of the American economy.

Understanding the Dow Jones history helps contextualize the magnitude of the 2008 stock market crash. While fluctuations are normal, the level of decline in 2008 was historic.

Prelude to the 2008 Stock Market Crash

The seeds of the financial crisis 2008 were planted years before, during a period of economic optimism, low interest rates, and easy credit. Banks were offering subprime mortgages to borrowers with poor credit histories, leading to the creation of risky mortgage-backed securities (MBS).

These practices inflated housing prices and created a fragile financial ecosystem. Financial institutions were overleveraged, and regulation was weak.

The Housing Bubble Burst

By mid-2007, housing prices began to fall. Borrowers started defaulting on their mortgages, triggering the housing bubble burst 2008. The value of MBS plummeted, and banks holding these assets faced massive losses.

This housing collapse was the catalyst for the economic meltdown 2008, as it exposed systemic weaknesses and unsustainable risk-taking in the financial sector.

The Lehman Brothers Collapse

One of the most defining moments of the Wall Street crash 2008 was the fall of Lehman Brothers. On September 15, 2008, the 158-year-old investment bank filed for bankruptcy—the largest in U.S. history.

The Lehman Brothers collapse sent shockwaves through global markets. It led to a complete breakdown of trust in the financial system, freezing credit markets and triggering panic selling on Wall Street.

Timeline of the 2008 Dow Jones Crash

Let’s look at key moments:

- September 15, 2008: Lehman Brothers files for bankruptcy.

- September 29, 2008: Dow Jones drops 777.68 points—its largest single-day point loss at the time.

- October 6–10, 2008: The DJIA loses over 1,800 points in one week.

- October 2008 to March 2009: Continued market volatility leads the S&P 500 to lose over 50% of its peak value.

The Dow Jones 2008 crash erased trillions in market value, devastated retirement portfolios, and triggered a loss of consumer confidence.

Impact on the U.S. and Global Markets

The US stock market crash 2008 didn’t happen in isolation. Global markets mirrored the plunge:

- European banks reported massive losses.

- Asian markets faced similar declines.

- Global GDP growth slowed dramatically.

The crash significantly damaged job markets, housing, and consumer spending, leading to the Great Recession impact that would last for years.

S&P 500 and Wall Street in 2008

The S&P 500 2008 crash mirrored the Dow’s trajectory. It lost nearly 57% of its value between October 2007 and March 2009. Key sectors such as financials, real estate, and consumer discretionary were hit the hardest.

Wall Street’s 2008 crash also exposed major flaws in how credit agencies rated debt, as well as the interconnected risks that few fully understood.

Government Response and Bailouts

In response to the crisis:

- The Federal Reserve slashed interest rates to near zero.

- Congress passed the Troubled Asset Relief Program (TARP), authorizing $700 billion to stabilize banks.

- The Fed launched quantitative easing to inject liquidity into the economy.

These efforts helped prevent a total collapse and provided a foundation for recovery.

Great Recession: Short and Long-Term Effects

The Great Recession impact included:

Short-Term:

- Unemployment peaked at 10% in 2009.

- Foreclosures hit record levels.

- Consumer spending plummeted.

Long-Term:

- Wealth inequality widened.

- Trust in financial institutions declined.

- Stricter regulations, like the Dodd-Frank Act, were implemented.

The psychological impact of the crash still influences investment behavior today.

Lessons Learned From the Crash

The 2008 stock market crash offered several hard-earned lessons:

- Financial systems require stronger oversight.

- Diversification and risk assessment are vital.

- Markets are interconnected—one collapse can trigger global effects.

- Government intervention, while controversial, can stabilize systemic threats.

Dow Jones History: Crash Comparisons

To understand the Dow Jones 2008 crash, let’s compare it to others:

| Crash | DJIA Drop | Cause |

|---|---|---|

| 1929 | -89% | Stock speculation |

| 1987 | -22.6% in one day | Automated trading |

| 2000 | -38% | Dot-com bubble burst |

| 2008 | -54% peak to trough | Housing and credit crisis |

While the economic meltdown 2008 was severe, the recovery eventually outpaced even previous rebounds.

Could It Happen Again?

Could another crash like 2008 happen?

While safeguards have been introduced, such as stress tests and liquidity requirements, risks remain:

- Shadow banking systems are growing.

- Derivatives are still widely used.

- Market confidence can shift quickly due to geopolitical tensions, pandemics, or policy errors.

Staying informed and prepared is key to weathering future downturns.

Conclusion

The Dow Jones 2008 crash was more than a financial event—it reshaped economies, livelihoods, and trust in institutions. By examining the Lehman Brothers collapse, the housing bubble burst, and the ripple effects of the financial crisis 2008, we can better understand today’s markets and prepare for tomorrow.

The US stock market crash 2008 was a wake-up call. Whether you’re an investor, policymaker, or everyday citizen, the lessons it taught remain essential in navigating future financial uncertainty.

External Sources:

Federal Reserve Bank of Minneapolis

Wikipedia – United States Bear Market of 2007–2009