U.S. stock market crash

In just a matter of days, the U.S. stock market crash has seen over $5 trillion in market value erased, triggering widespread panic among investors and analysts alike. This 2025 stock market crash is being likened to historic downturns such as the Great Depression of 1929, Black Monday in 1987, the 2000 Dot-com bubble, the 2008 financial crisis, and the COVID crash of 2020. As Wall Street reels from massive losses, questions arise: what triggered this financial collapse, and what does it mean for the global economy?

Here’s some brief information about all above stock market crash and some technical parallels between 2025 crash and historical market collapses.

Great Depression of 1929

The Great Depression of 1929 remains the most devastating economic collapse in modern history. It began with the infamous stock market crash on October 29, 1929 (Black Tuesday), which erased billions of dollars in wealth virtually overnight. Banks failed, unemployment skyrocketed to nearly 25%, and the global economy spiralled into a decade-long depression. The 2025 crash, while different in its causes—primarily driven by trade policies and tariffs—evokes echoes of the 1929 panic, as investor confidence plummets and trillions in market value vanish in a matter of days.

Black Monday in 1987

On October 19, 1987, global financial markets witnessed one of the most dramatic single-day crashes in history—Black Monday. The Dow Jones Industrial Average fell an unprecedented 22.6% in just one session, a record that still stands today. Though the underlying economy remained relatively strong, automated trading and panic selling exacerbated the fall. In comparison, the 2025 market decline is more sustained and policy-driven, yet the sharp drops in the S&P 500, Dow Jones, and Nasdaq are reminiscent of the shockwaves seen in 1987.

Dot-com Bubble Burst of 2000

The early 2000s saw the collapse of the Dot-com bubble, a period marked by excessive speculation in internet-based companies. When overvalued tech stocks began to falter in 2000, the Nasdaq Composite lost nearly 80% of its value by 2002. Much like the 2025 crash, tech giants bore the brunt of investor losses. In today’s case, however, it’s tariff-related uncertainty and trade wars rather than over-speculation driving the fall—proving that even robust technology firms are not immune to geopolitical pressures.

2008 Financial Crisis

The 2008 financial crisis was triggered by the collapse of the housing market and a cascade of failures in the global banking system. Major financial institutions crumbled under the weight of bad debt and mortgage-backed securities, leading to a global recession. Government bailouts and central bank interventions eventually stabilized markets. While the 2025 market crash stems from a different cause—trade tariffs and retaliations—the scale of financial sector stock losses and the fear of a looming recession draw strong parallels to the chaos of 2008.

COVID Crash of 2020

The COVID crash of 2020 was a swift and brutal market downturn sparked by the global outbreak of the coronavirus pandemic. Lockdowns, travel bans, and economic shutdowns created a sharp, sudden drop in stock prices, with the S&P 500 falling more than 30% in just a few weeks. However, aggressive stimulus measures helped markets rebound quickly. In contrast, the 2025 downturn is not driven by a health crisis, but by geopolitical conflict and economic policies—which may make recovery slower and more unpredictable, especially amid rising recession fears.

Technical Parallels Between the 2025 Stock Market Crash and Historical Market Collapses

While each market crash had its unique triggers—ranging from speculative bubbles to pandemics—the 2025 stock market crash shares striking technical similarities with its predecessors. These patterns provide valuable insight into investor behaviour and market dynamics during times of extreme volatility:

1. Sharp Liquidity Crunches and Panic Selling

- 2025 vs. 1929 & 1987: Just like during the Great Depression and Black Monday, the 2025 crash witnessed a sudden spike in panic selling. High-frequency trading systems and algorithmic strategies exacerbated intraday volatility, amplifying losses during market open and close.

- Flash-like drops in Dow Jones and S&P 500 prices were seen over back-to-back sessions—mirroring the herd behavior in earlier crashes.

2. Correlation Breakdown Across Asset Classes

- In 2025, diversified portfolios failed to protect investors, as equities, bonds, and even some commodities sold off simultaneously—a phenomenon also witnessed during the 2008 financial crisis and COVID crash of 2020.

- This breakdown in correlation reflects deep systemic stress and a rush for cash over quality.

3. Sector-Wide Declines and Concentrated Losses in Tech & Financials

- Like the Dot-com bubble and 2008 meltdown, the 2025 crash was marked by concentrated losses in the technology and financial sectors.

- Tech stocks—once market leaders—saw their valuations evaporate quickly, while banks faced growing risks due to global economic slowdown, tariff uncertainty, and exposure to volatile markets.

4. Entry into Bear Market Territory

- The Nasdaq officially entered a bear market (a drop of 20% or more from recent highs) within days—an indicator echoed in past collapses such as in 2000 and 2020.

- The speed and scale of this drop is almost identical to how the COVID crash unfolded in March 2020, although the catalyst this time is tariff policy, not a global health crisis.

5. Breakdowns of Key Support Levels and Technical Indicators

- In all previous crashes, major indices breached key support levels like the 200-day and 50-day moving averages, often triggering automated sell orders and deepening the downturn.

- The 2025 crash followed suit, with the S&P 500 and Dow Jones Industrial Average both collapsing below long-term moving averages—spurring institutional exits and large-volume selling.

6. Spikes in Volatility (VIX) and Investor Fear

- The CBOE Volatility Index (VIX)—known as the “fear gauge”—spiked sharply during the 2025 crash, similar to its movements during 2008 and 2020.

- Elevated VIX levels are a hallmark of panic-driven markets and reflect rapidly changing investor expectations and risk premiums.

7. Global Contagion and Interconnected Selloffs

- As seen in 2008 and 1987, the 2025 crash quickly spread beyond the U.S., with Asian and European markets reacting in sync to U.S. tariff announcements and retaliations.

- The global market reaction to U.S.-China trade tensions revealed how interconnected modern financial systems are—and how quickly sentiment can spread across borders.

8. Media & Sentiment-Driven Acceleration

- In 1929 and again in 2020, negative headlines accelerated the downturn. Similarly, in 2025, media coverage of phrases like “$5 trillion wiped out,” “Trump’s tariffs spark crash,” and “China retaliates” added emotional fuel to the selloff.

- Sentiment analysis of online and social media content during the crash shows a steep rise in bearish commentary—triggering retail investor exits and algorithmic trend-based selling.

Wall Street Losses in April 2025: What Triggered the Collapse?

The crash was catalyzed by President Donald Trump’s aggressive trade stance. New tariffs imposed on key international partners, especially China, led to immediate retaliation. In response, China’s retaliatory tariffs in 2025 slapped U.S. exports with severe levies, creating panic across trading floors.

The result? An S&P 500 significant drop, a sharp Dow Jones Industrial Average decline, and a Nasdaq bear market entry—with the tech-heavy index plunging over 20% from its recent peak.

The Impact of Tariffs on the Stock Market Crash

Tariffs have once again proven to be double-edged swords. While aimed at protecting domestic industries, they triggered severe market volatility. The impact of tariffs on the stock market this time around was profound—especially in the technology sector and financial institutions, both of which experienced dramatic declines in valuation.

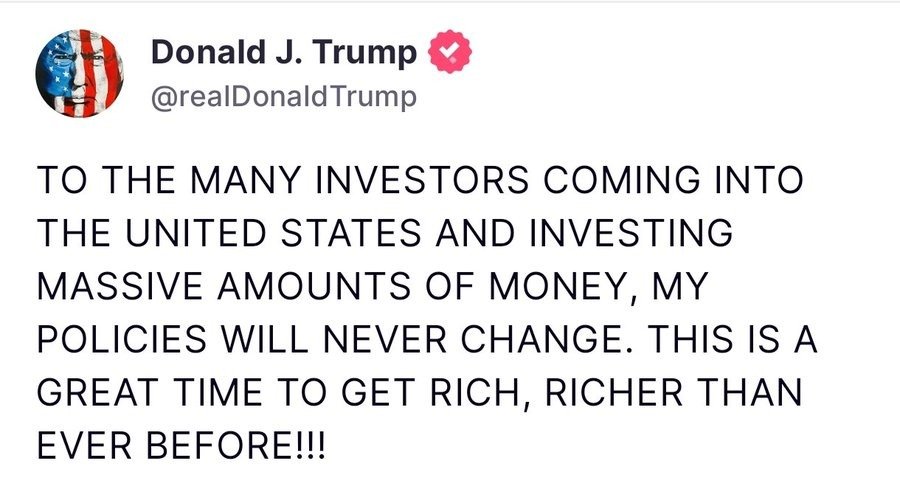

President Trump, however, remained upbeat, stating, “It’s a great time to get richer.” While his confidence may reassure loyal investors, the markets are painting a starkly different picture.

Investor Concerns Over Trade War Spark Panic

This crash reflects deeper investor concerns over an escalating trade war. As tensions mount between the world’s two largest economies, the global market reaction to U.S.-China trade tensions has been overwhelmingly negative. Investors are now pricing in not just a prolonged trade battle, but also the economic implications of new tariffs, supply chain disruptions, and deteriorating international relations.

Sector Spotlight: Financial & Tech Stocks Take a Hit

- Financial sector stock losses have been brutal, with major banks like JPMorgan and Goldman Sachs shedding billions in market cap.

- The technology sector market impact is equally staggering. The “Magnificent Seven” tech giants have collectively lost over $1.6 trillion.

Recession Fears Loom Large

With such a massive value wiped out and no immediate resolution to the trade war in sight, recession fears amid the stock market decline are growing stronger. Analysts are warning that if this downward trend continues, the U.S. could slip into a full-blown recession by the end of 2025.

Looking Ahead

Is this a temporary panic or the beginning of a prolonged downturn? One thing is certain—the U.S. stock market downturn in 2025 will be studied alongside historic financial catastrophes. Whether this becomes an opportunity, as Trump claims, or a deeper crisis, investors should brace for turbulent months ahead. Please refer Tump’s 2025 economic plant https://usatrendalert.com/blog/trumps-economic-plan-makes-complete-sense/

Frequently Asked Questions (FAQs)

1. What caused the $5 trillion wipe-out from the US stock market crash in 2025?

The 2025 market crash was primarily triggered by aggressive trade policies, especially new tariffs imposed by the U.S. government. In response, China enacted retaliatory tariffs, escalating tensions and sparking fears of a prolonged trade war. These events caused widespread investor panic, leading to historic losses across the S&P 500, Dow Jones, and Nasdaq.

2. How does the 2025 stock market crash compare to past crashes like 1929, 1987, or 2008?

The 2025 crash shares several technical similarities with past collapses: sharp liquidity crunches, sector-wide declines, high volatility, bear market entries, and global contagion. While the triggers differ—tariffs and geopolitics in 2025 vs. speculation or financial instability in the past—the patterns of panic selling and market breakdowns are strikingly similar.

3. Did Trump’s tariffs directly cause the stock market crash in 2025?

While multiple factors contributed, Trump’s tariffs are widely viewed as the primary catalyst. The policy changes led to heightened uncertainty, supply chain disruption, and immediate retaliation from China, shaking investor confidence and accelerating sell-offs across global markets.

4. Which sectors were hit hardest during the 2025 stock market stock crash?

The technology and financial sectors took the brunt of the impact. Tech stocks—once considered market leaders—saw their valuations plummet, while financial institutions suffered from rising global risk and market volatility. Energy and manufacturing also faced challenges due to trade restrictions.

5. Has the Nasdaq officially entered a bear market in 2025?

Yes, the Nasdaq Composite entered bear market territory, dropping more than 20% from its recent high. This mirrors previous events like the 2000 Dot-com crash and 2020 COVID crash, where tech-heavy indexes led the downturn.

6. Are we heading into a recession because of the 2025 market crash?

Many economists warn that the scale of losses and ongoing trade tensions raise the risk of a recession. Declines in consumer confidence, tightened corporate earnings, and disrupted global trade could lead to an economic slowdown later in the year.

7. How did global markets react to the US stock market crash in 2025?

Global markets mirrored the U.S. panic. Major indexes in Asia, Europe, and emerging markets all saw significant declines in response to escalating U.S.-China trade tensions, proving how interconnected today’s financial systems are.

8. Why is this crash being compared to the Great Depression and other historic events?

The comparison comes from the scale and speed of market value loss—over $5 trillion evaporated in a matter of days, reminiscent of the 1929 crash, Black Monday in 1987, and 2008 financial crisis. Analysts also cite similar investor behaviour patterns and technical breakdowns.

9. What is the impact of China’s retaliatory tariffs in 2025?

China’s retaliatory tariffs have worsened the economic outlook, affecting U.S. exports, manufacturing, and tech firms with global supply chains. The tit-for-tat nature of this trade war is causing long-term uncertainty for both investors and multinational businesses.

10. Is now a good time to invest in the market, as Trump suggests?

While President Trump claimed it’s a “great time to get richer,” many analysts urge caution. Volatility is high, and without clear resolution to the trade conflict, markets may remain unstable. Long-term investors should focus on fundamentals and risk management.

1 thought on “$5 Trillion Lost in 2025 U.S. Stock Market Crash – What Happened?”

Comments are closed.